When working in Japan, every month we have to pay tax based on our income. he year-end tax refund procedure is understood as that part of the tax that can be refunded or reduced when the employee completes tax adjustment procedures. This is also the right of every individual when living and working in Japan.

What is the year-end tax refund procedure?

ax declaration is an individual’s obligation, but letting employees pay and declare tax themselves will be quite difficult and time-consuming. This also requires having to pay tax at the end of the year with a large amount of money, (usually 10-15 man or more depending on income).

Therefore, companies will deduct part of their monthly income to pay first on behalf of employees to the tax department, then at the end of the year will make tax adjustments to declare the actual amounts.

The purpose of this adjustment procedure is to:

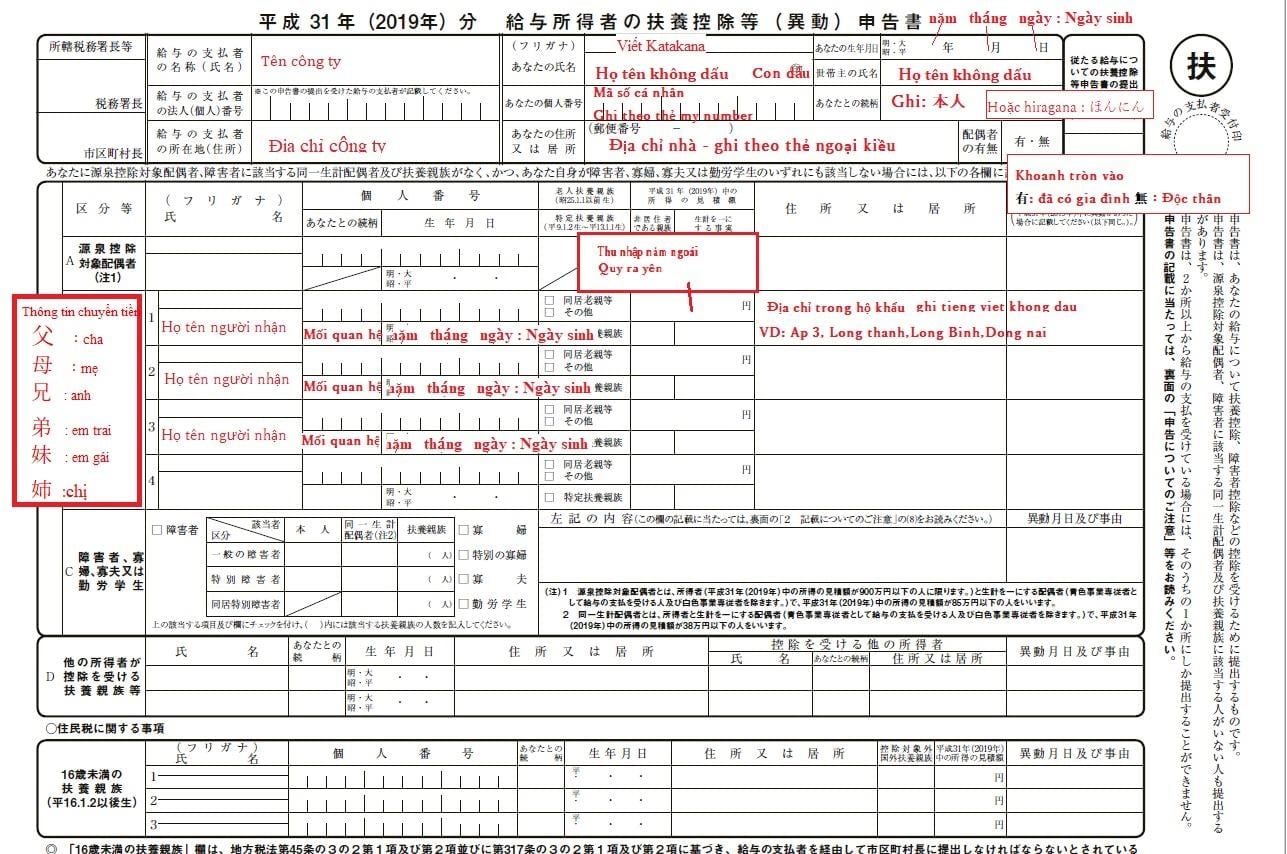

– Confirm the change of dependents (the person you are supporting by sending money to your home country)

– Declare other tax deductions incurred in that year.

* For example: health insurance, etc. The tax office will compare the records and finalize the amount you need to pay.

=>→If it is higher than the amount that the company has deducted monthly, you need to pay more.

=> In the lower case, the tax will be refunded.

* For example, in the previous years, if you have not done this tax adjustment procedure, the department will collect 100% of tax (because there is no information about who you are sending money to to support). If you do this procedure this year, after the application is approved, the department will refund the tax you have paid.

What taxes are refunded and reduced?

Income Tax (所得税): Is a tax calculated on the total annual income of employees. Usually the company will deduct from the monthly salary to help employees pay this tax.

Citizenship Tax (住民税): Also known as resident tax, will be used to serve the local education, waste treatment, welfare, disaster prevention. The resident tax will be calculated based on the total income of the previous year, and paid in May-June each year.

How much income need to pay tax?

Total income in a year will be calculated for the period from January 1 to December 31, in which for:

Income Tax (所得税): Over 103 man/year will have to start paying tax.

Citizenship tax (住民税): Normally, if your annual income exceeds 1 million yen, you will be required to start paying it. However, it will depend on the regulations of each locality rather than having a specific prescribed amount.

How much tax will be refunded?

Currently, for 1 registered dependent, the tax reduction will be as follows:

Income tax: about 2 man/person/year

City tax: about 3.5 man/person/year

=> Total: 5.5 man/person/year

Example: You have to pay tax of 15 man/year (both income tax + residence tax). You register 3 dependents

=> → Tax reduction: 3 (person) x 5.5 man = 16.5 man/year